https://www.livemint.com/market/stock-market-news/budget-2025-these-announcements-by-finance-minister-nirmala-sitharaman-could-revive-nifty-bulls-11738383037813.html

Budget 2025: These announcements by FM Sitharaman could revive Nifty bulls; here are top stocks to track today

Ahead of Budget 2025, expectations for growth-focused measures, tax concessions, and infrastructure spending are high to stimulate the economy and investor confidence amidst recent market declines.

Budget 2025 Expectations: Domestic equity indices have been on a downward trajectory for the past four months, declining over 13% from their peak and struggling to witness recovery. As Union Budget 2025 is set to be unveiled today, February 1, investors expect bold policy measures to revive growth, boost consumption and create jobs. Additionally, there are expectations of tax concessions that could provide much-needed relief to taxpayers, potentially stimulating market sentiment.

With economic growth showing signs of weakness and the rupee hovering near record lows, the government is expected to prioritise growth-oriented measures while ensuring fiscal prudence. Given healthy tax collections, the Budget may allocate higher spending on infrastructure, manufacturing, and rural development, which could support a market rebound. The Budget could also provide tax and regulatory incentives to stimulate the manufacturing sector to attract fresh investments and announce policy support for export-driven industries to mitigate trade-related uncertainties.

Despite global uncertainties, the Budget will likely adhere to its fiscal glide path, maintaining the fiscal deficit target of 4.5% of GDP. Significant FII outflows in recent months have added pressure on markets. Measures that enhance ease of doing business incentivise long-term investments or reduce capital gains tax burdens could improve investor confidence and attract fresh inflows. Further, heightened concerns over Donald Trump’s tariff threats on significant trading partners add to market volatility. A budget that reinforces economic resilience and strengthens domestic demand could act as a buffer against external shocks.

Even without big-bang reforms, a budget that delivers stability, avoids significant disappointments and reassures investors about economic direction could trigger a relief rally. Equity indices could rebound from seven-month lows and regain lost ground. While all sectors have specific expectations from Budget 2025, some are poised to take centre stage due to recent trends, policy priorities, and economic needs.

Budget 2025 is expected to drive economic growth and technological advancement across key industries. The government will likely focus on the Make in India initiative through increased allocations towards infrastructure and construction, Agri, defence, renewable energy, digital transformation and AI adoption, renewable energy and sustainability, and defence, all of which align with India’s long-term development vision.

Budget Impact on Markets

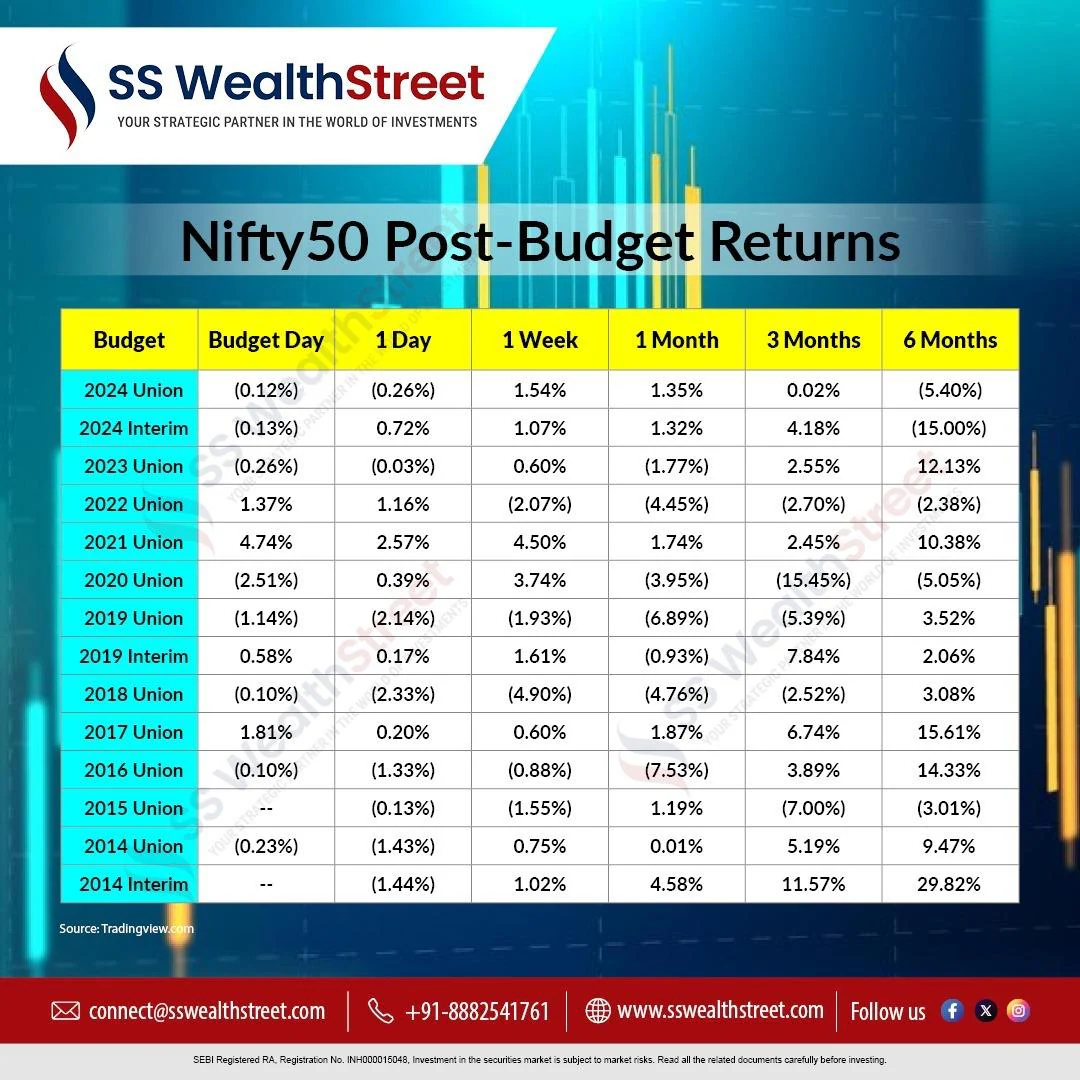

Historically, the stock market experiences heightened volatility in the weeks leading up to the Union Budget, with investors adopting a cautious stance amid speculation on key policy announcements. Over the past several years, indices have shown a tendency to correct by 1-5% in the two to three weeks leading up to the Budget, driven by profit-booking, risk aversion, and repositioning of portfolios in anticipation of potential policy shifts.

Data since 2014, covering both interim and full Union Budgets, suggests that markets mostly experience an initial dip on Budget Day. However, they tend to recover in the following week, primarily determined by how investors interpret fiscal policies, sectoral allocations, and the overall impact on economic growth.