Nifty50 Vs Gold Price

Explaining the nature of gold and equity investments, Sugandha Sachdeva, Founder of SS WealthStreet, said, “Gold and equities serve distinct but complementary purposes in a diversified investment portfolio. Equities allow investors to participate in the economic growth of a country. They provide the potential for high returns, which can significantly grow wealth over time. On the other hand, gold has long been revered for its role as a store of value, as it helps preserve purchasing power and provides stability and protection against losses. Together, they can create a balanced portfolio that aims for growth while managing risk. Investors can adjust the allocation of gold and equities based on market conditions, economic outlook, and personal financial goals.”

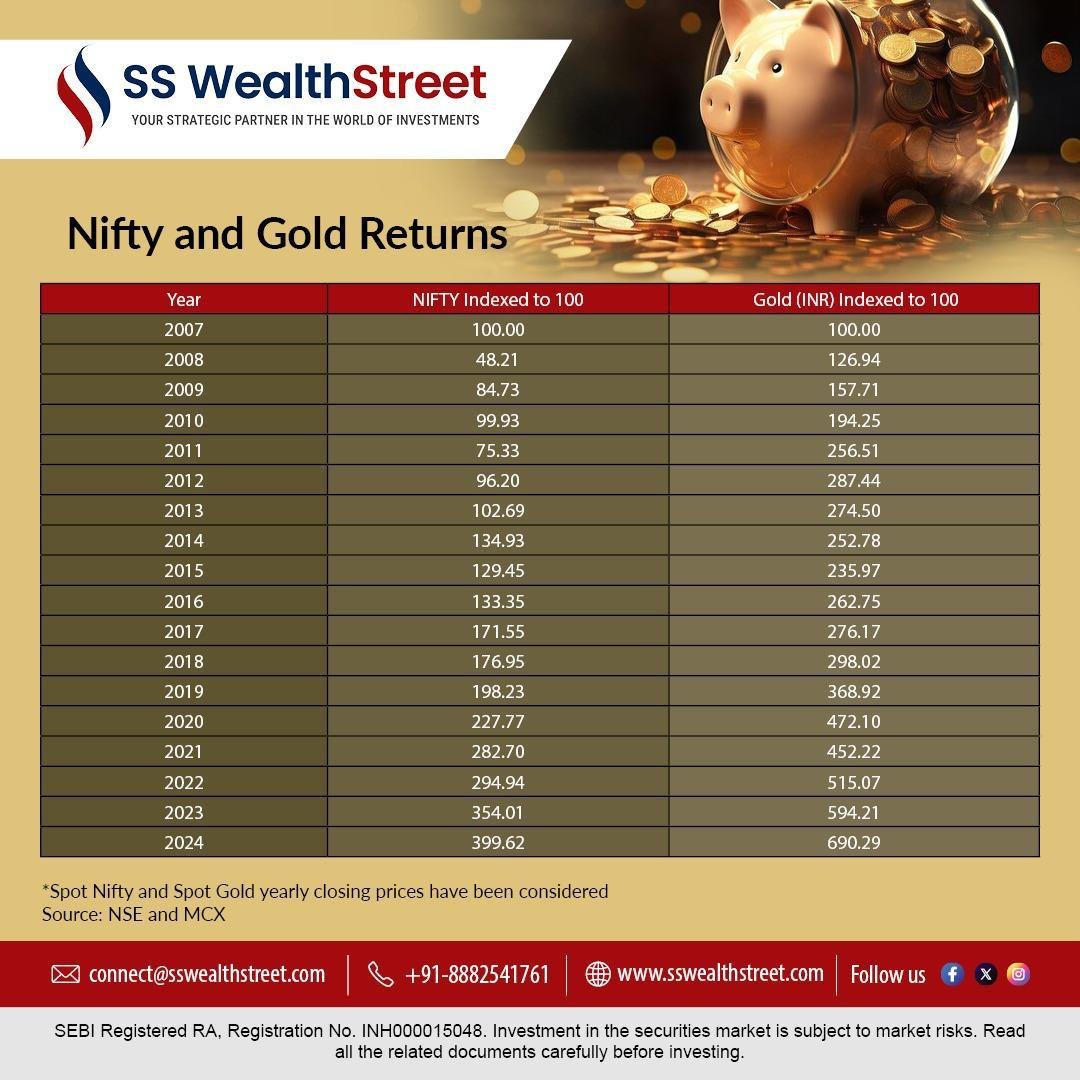

Taking the Nifty 50 index as a benchmark for the Indian equity return in the post-subprime loan crisis, Sugandha Sachdeva said, “While contrasting the price changes of Gold with the returns generated by the Nifty index post-subprime loan crisis, the period from the end of 2007 to 2024 has been analyzed. This could help in understanding the dynamics of Nifty and Gold, enabling investors to explore further and make informed decisions about these distinct investment categories. Both Nifty and Gold have given strong absolute returns from the beginning of 2008 till date. Still, Gold has outshined Nifty with absolute returns of around 590.29%, while Nifty 50 has generated 299.62% since the outbreak of the sub-prime crisis.”

“Gold price has moved from ₹10,592 per 10 gm to ₹73,115 per 10 gm in post-subprime loan crisis whereas the Nifty 50 index moved from 6,138 to 24,540 mark in this period,” she added.

How your ₹100 would have fared?

On how one’s ₹100 would have fared in the last 16 years post-subprime mortgage crisis, Sugandha said, “A ₹100 invested in gold at the end of 2007 would have become ₹690.29, while the same amount invested in the Nifty 50 index would have become ₹399.62.”

Triggers for gold price

Asked about the factors that enabled gold to outshine the Nifty 50 index in post-financial crisis 2008, the SS WealthStreet founder said, “These excellent returns generated by gold can be attributed largely to post-crisis uncertainty which led investors to seek safe-haven assets, acting as a strong hedge against financial turmoil. Further, massive liquidity infusion by global central banks, low interest rate regime, gold buying by major central banks, trade tensions, and Indian rupee depreciation have acted as tailwinds, contributing to the upward trajectory displayed by gold. The Indian rupee was trading around 39.38 to a dollar in 2008, while it has depreciated to record lows of around 83.71 mark recently.”

Regarding the equity market journey post-subprime mortgage loan crisis, Sugandha said, “Nifty started recovering in 2009 after the steep fall witnessed in the 2008 crisis and has generated stellar returns. Various factors that led to the strong performance of the benchmark index have been the economic recovery owing to coordinated efforts by various central banks and governments across the globe, including India, to revive growth, monetary easing, and quantitative easing programs of the developed world. Besides, improved corporate earnings, strong reforms momentum, rising urbanization, robust consumption, rapid digital transformation, the influx of foreign capital, and surge in retail investments after the COVID-19 pandemic reflecting investors’ confidence have largely supported the benchmark.”